Last week, Nick attended a breakfast event at The Savoy reflecting on retail performance over the last year and contemplating prospects for the year ahead.

Editors

- Nick Strachan, Director

Hosted by Movers & Shakers in collaboration with Revo, the session considered the performance of UK town centres & high streets with a deeper dive into shopping centres and out-of-town retail.

The key trends were nicely summarised by Mark Stansfield, Senior Director of UK Analytics at CoStar, who concluded that whilst the UK economy has lost some momentum, brighter days are (hopefully) ahead. He presented evidence to demonstrate that retail conditions and leasing activity appears to be improving, with some parts of the market even outperforming expectations- prime shopping centres including our scheme at Atria Watford were referenced as examples where there have been significant tenant expansions and upgrades as availability has sunk, pushing demand. Perhaps the most tangible example of this is Oxford Street, where retail vacancy has dropped and unit availability is at a five-year low, demonstrating perhaps that the spree of retail closures & redevelopments may have right-sized the retail offer. Although retail new-build construction is running at record low-levels, the drive for repurposing and reconfiguration of retail space continues at pace.

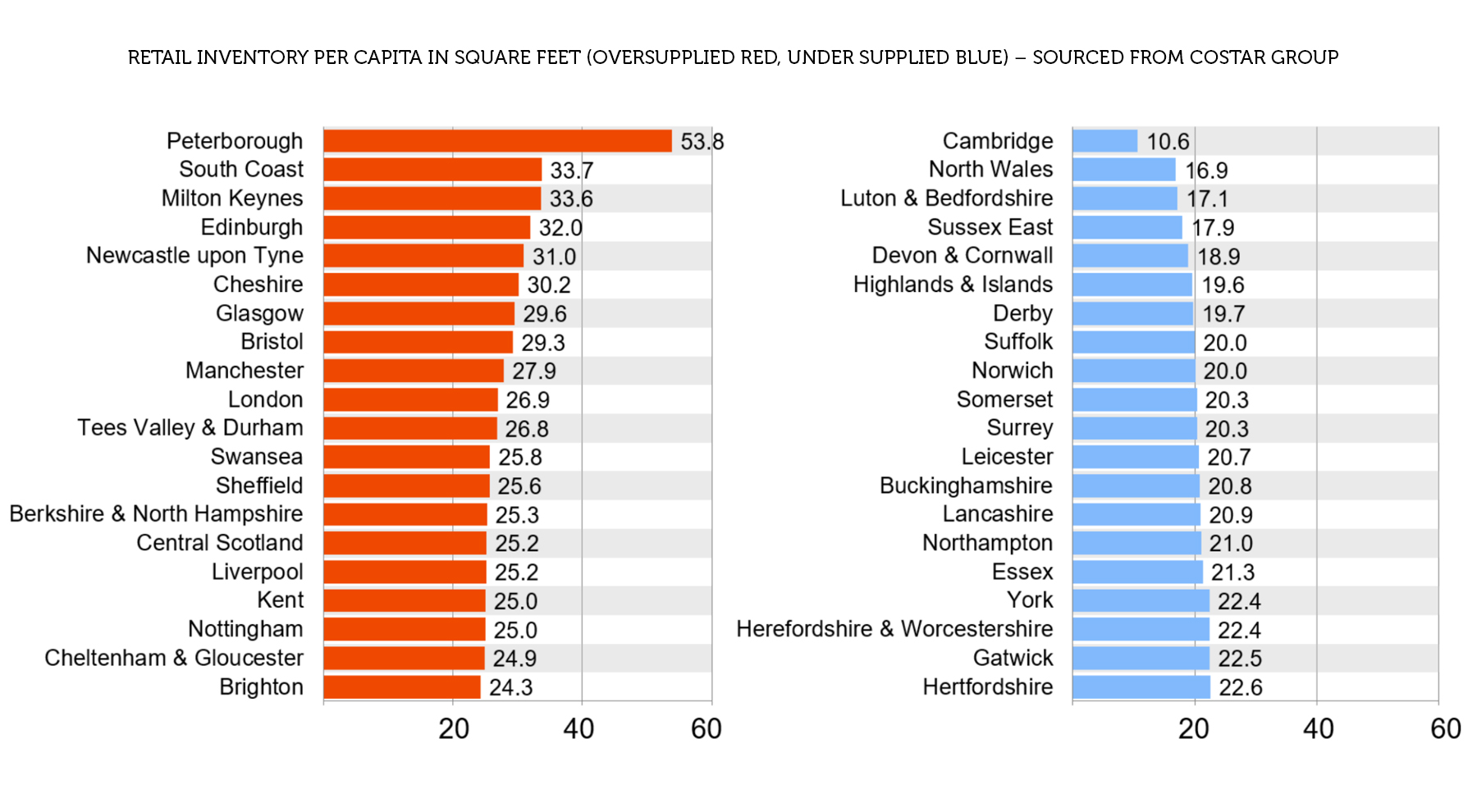

Whilst the market of course remains earnest as overprovision of retail remains an issue in many UK town centres, data suggested that some parts of the UK are even undersupplied by retail, providing some optimism that investors will return. Indeed many mall owners have crystallised heavy losses through 2023 and 2024, and more buyers are coming out sensing bargains.

It appears that the proportion of internet sales as a percentage of overall retail sales has plateaued at around a third of the market share, offering hope that the market has stabilised to find a place for both online and physical shopping. However, the debate concluded with a sombre note as there are of course risks on the horizon, given recent geo-political events, namely:

• Global politics known unknowns (USA, Russia, Israel, Far East etc)

• Fear of inflation and rates being held high, slowing spending (Autumn Budget 2024)

• Tax and wage rises eroding retailer margins and slowing transactions or causing closures

Thank you to all who presented and took part, we look towards 2025 with excited anticipation